Need of proof of funding for your student residence permit in Germany? I went with the Expatrio Blocked Account and am here to share my personal experience.

One of the major requirements when moving to Germany to study is proving you can financially support yourself during your stay. One way to show financial stability is with a Sperrkonto, a special blocked account for international students.

While there are a few options out there, I went with Expatrio’s blocked account because they proved to be one of the most convenient options for Americans.

Here’s everything you need to know about the Expatrio blocked account services.

This post may contain affiliate links, meaning at no additional cost to you, if you click my links and make a purchase, I may earn a small commission. Learn more on my disclosure page. Thank you for your support!

What is a blocked account in Germany?

A Sperrkonto is a blocked account is a particular account for students in Germany and is needed to apply for a German residence permit. A blocked account ensures that all students in Germany can financially support themselves during a year of studies.

A German blocked account is unique because you can only receive a set monthly withdrawal from it each month, an amount that’s dictated by the German government. The monthly dispersal amount is set at €934 per month, which is the max withdrawal you’ll get from your blocked account every month.

However, when you first open the account, you’ll need to put a total of €11,208 for the year (or corresponding total to cover your length of stay). After it’s set up, you can’t put any more money in, and you can’t take any more out.

Where to get a blocked bank account for Germany’s Student Visa

I went with Expatrio, but there are a few different providers that students in Germany can choose from when opening a blocked account.

The other best blocked accounts in Germany

Fintiba is arguably one of the most popular and convenient options for students. They offer both blocked account services and health insurance making it easy to take care of two essential things in one process. However, they do not accept Americans for tax purposes.

Deutsche Bank is Germany’s national bank and the more official choice. They’re on the pricier end of options and have a bit of a complicated application process that requires applying through the nearest embassy in your home country. But they are Germany’s largest bank which I suppose you could infer makes it the most reputable.

Coracle is another blocked account provider and is a company I’d say is on par with Expatrio. They claim to be the cheapest on the market, and the entire application process takes place conveniently online.

My Review of the Expatrio Blocked Account

I used the Expatrio blocked account for a total of three years (the entirety of my studies in Germany) and am ready to share what I know to help you make an informed decision!

How to sign up for the Expatrio blocked account

Applying for a blocked account with Expatrio is pretty straightforward and is completely done online. To calculate the amount needed, you’ll need to first fill out the information about your stay in Germany, like your plans/type of study and how long you’re staying.

You’ll then need to decide if you’ll get your health insurance through Expatrio. Expatrio helps incoming students under 30 apply for Techniker Krankenkasse (TK), Germany’s reputable public health insurance provider. They also help with private insurance for those over 30. I ultimately decided to apply for my health insurance independently. But why not make it easy on yourself and have them help you?

Next, you’ll need to provide all your personal information and upload a scanned copy of your passport. Expatrio will verify your documents and get back to you typically in 24 hours if accepted.

Finally, you’ll need to transfer the money from your bank account to your new Expatrio Blocked Account.

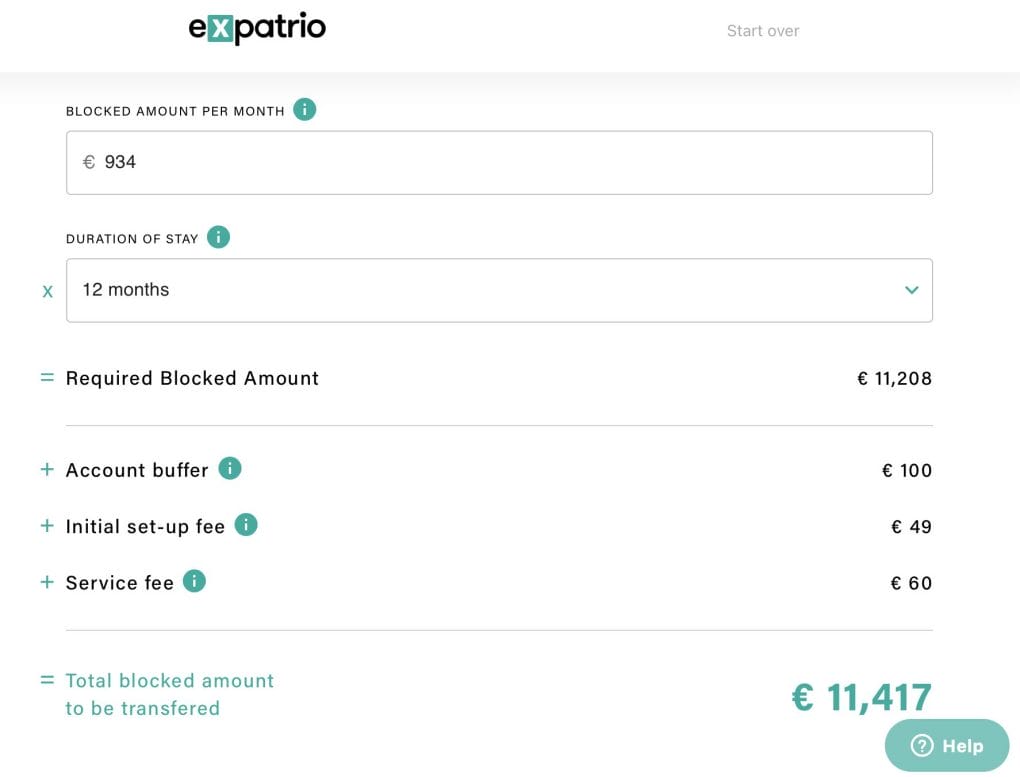

How much does Expatrio cost?

The Expatrio Blocked account costs €49 to set up and then a €5 per month fee. This amount is all paid upfront and taken from your blocked account, so you don’t need to worry about making separate payments.

Expatrio also has you deposit a €100 buffer to account for any transfer fees or weird exchange rates when you send the money to Expatrio from your home bank, but this is not technically a fee from them.

How much is needed in your blocked account to study in Germany?

Of course, you’ll also need the blocked amount to satisfy the visa requirements, which equates to a total of €11,208 for the year or €934 a month, as of January 2023.

Including the Expatrio fees (€49 to set up, €5 monthly fee, €100 buffer), you’ll need €11,417 to open an Expatrio blocked account for a year of studies (roughly $12,000+ depending on the exchange rate).

Students enrolled in programs longer than one year will need to reactivate their blocked accounts at the beginning of their second year. This process is completed online in your account and costs all the same fees.

When to apply for Expatrio’s Blocked Account

I recommend applying for your Expatrio blocked account at least two weeks before your residence permit interview. If you’re a nervous Nelly like me, it doesn’t hurt to do it even earlier.

A rough timeline looks like this: The blocked account application process takes mere minutes, and I believe it took about 24 hours to validate my passport information. An international transfer can take anywhere between 2-5+ days to arrive in your blocked account.

Once that’s all been taken care of, Expatrio should send you the blocked amount confirmation document in one business day.

The Blocked Amount Confirmation document is needed to apply for your student residence permit. Expatrio only gives you this official document once they have received the money.

How to Transfer Money to Expatrio Blocked Account

Transferring money, especially a large sum, is super stressful and expensive. Not only are you sending off a large chunk of money, but you’re also on the hook for hefty fees.

You can contact your at-home bank about setting up an international wire. You’ll need the Expatrio bank information like the account number, routing number, bank name (in this case, Expatrio uses Mangopay), and address. All of this info is in your Expatrio account portal.

Activating your Expatrio Blocked Account

After the money has arrived in your blocked account, you’re halfway there. You actually can’t access the funds directly in your blocked account.

To access the money and use it for rent, food, etc., you’ll need to set up a regular personal bank account in Germany. Many students opt to open an account with N26 (no fees and online application!) or with one of Germany’s big banks like Sparkasse or Deutsche Bank.

After setting up your bank account, you hook it up to your blocked account online in your account portal, where you’ll also find an activate button. Once you activate it, you’ll start receiving direct monthly payments to your German personal checking account every month.

Is Expatrio Trustworthy?

Overall, yes. I used Expatrio for the entirety of my studies (3.5 years) and never had any issues with them. Not when I first opened the account and not when I reactivated it for additional semesters.

However, in my initial research, I did read some negative reviews. For example, some people had reported issues getting their Expatrio blocked account refunded in a timely fashion when they didn’t go through with their move to Germany.

However, those reviews were few and far between compared to the many more positive ones. I also found that the other blocked account options had about the same number of negative to positive reviews. And in the end, I’ve had an overall easy experience with Expatrio, and that’s really all I can comment on!

Do I recommend the blocked account with Expatrio?

I do believe, aside from the issues mentioned above, Expatrio offers one of the best blocked accounts in Germany.

I haven’t had any issues with them myself, and it truly was beyond easy and convenient to get it set up. I was able to apply, deposit the money, and complete the process in a week. They also offer convenient insurance bundles along with the blocked account so that you can kill two birds with one stone.

I was also able to apply when I was already in Germany, which I recommend because it allows you to get your German address and local bank account set up before applying for the blocked account. Which means you can use this needed information on your initial application without having to backtrack and update Expatrio with this information later.